The Client

The client is a financial services company that runs an Android app to help people check their creditworthiness and financial profile. The app assists people with a complete financial health check-up - from CIBIL scores, credit utilization, loan account statuses to Red Flags. It informs people of their repayments and overdue and guides them to remain financially sound.

Industry

Finance

Tech Stack

Node.js, React Native, Figma, i2i API, CRIF, PostgreSQL, Cashfree, AWS

The Challenges

The client’s vision was to launch a Fintech app that helps track insightful credit reports and CIBIL scores. Capital Numbers was a chosen partner for the job because of its previous Fintech development experiences and a good understanding of the Fintech landscape.

The company turned to us for this Android-based Fintech app that involved the implementation of the following features:

- OTP Logins

- Financial Profile Creation

- CIBIL Scores

- Credit Utilization Ratio (CUR)

- Repayment History

- Age of Credit

- Credit Behavior

- Negative Accounts

- Red Flags

The work required us to connect the app with third-party API services to fetch financial data. The idea was to show consumers where their financial risks are coming from. In case of financial risks, we had to trigger conditions to alert users about Red Flags (or potential disputes).

The critical point was that we didn’t just need to extract financial data. We also had to inject code that helped obtain analytical insights around that financial information. That is, we had to add the necessary algorithms that scan and score consumers based on their financial records.

All this needed us to implement a robust user flow. Plus, we had to maintain velocity and quality from start to end to ensure a seamless rollout.

Solutions We Offered

We began the work with an initial analysis of the practical limitations, improvement areas, and credit information sources we needed to consider. We then finalized an advanced tech stack and started moving ahead with the implementations.

We used Figma to wireframe the layout first. Figma helps customize multiple app screens. So, we used Figma to chalk out the wireframe and then proceeded with the code.

We developed the backend using Node.js because it’s highly extensible. As for the frontend, we chose React Native because it allows creating complex UIs and adding modifications during runtime.

We next integrated the i2i third-party API service to extract and show financial data on the app. The i2i API offers excellent credit information by considering 50+ parameters like people’s debt-income ratios, employability, bank account statements, etc. So, i2i was the ideal fit for drawing credit information. However, during i2i integration, we encountered several 503 Errors and ‘Null’ value issues. But we tracked and fixed them all.

We also used the CRIF API service to extract CIBIL Scores. CRIF helps find large amounts of credit information about people. But, because we didn’t need all the information, we injected rule-based engines to generate CIBIL Scores around specific financial indices. We also set predefined conditions to show Red Flags under ‘potentially risky’ financial conditions.

As for the database, we used PostgreSQL as it has multiple layers for checking bank accounts, balances, statements, etc. It hardens databases against threats and best meets Fintech database demands.

We used the Cashfree payment gateway to allow paid subscriptions. Once users pay for subscriptions, they can avail of advanced services, such as monthly credit reports, expert advice, etc.

At one of these development stages, our client asked us to insert a pre-built dataset of 25K+ financial entries at short notice. We found the dataset had multiple errors. But, we tactfully modified all errors and inserted a well-structured dataset without impacting the rest of the code.

The final testing was challenging, too, as we had to test the app with actual bank statements and not arbitrary docs. However, we tested every functionality successfully without facing setbacks before hosting the app on the AWS server.

Technology

Results

In 6 months, Capital Numbers designed, developed, and launched the Android app on Google Play Store. Here’s more on how the app shaped up and the features it offers:

OTP-based Login

The app allows users to register via phone numbers and OTP verifications. This is a time-saver.

Financial Profile Creation

Once users log in, they need to complete their financial profile by adding the following:

- Names

- Contact numbers

- Income details

- Bank statements

- Unique identification numbers, etc.

After updating their financial profile, users get access to their CIBIL and Credit scores.

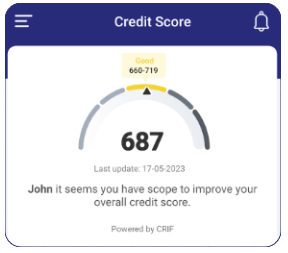

CIBIL Scores

Users see their CIBIL scores to understand their chances of getting pre-approved or personal loans from banks.

Credit Scores

Below the CIBIL Scores, users see their credit scores or financial indices, which affect their CIBIL scores.

| Credit Utilization Ratio or CUR (in %) | Repayment History (in %) | Age of Credit (in months) |

|---|---|---|

| 0% This is a percentage figure representing the amount of credit a user uses divided by the amount of credit available. If the ratio is high, it means a poor credit score. | 100% This includes a user’s payment details, such as on-time and late payments. The more the number of on-time payments, the higher the credit score. | 35 months This reviews a user’s newest and oldest loan accounts to determine the average credit age. The longer the credit history, the higher the credit score. |

| Credit Behavior (in %) | Credit Enquiries (per year) | Negative Accounts (per year) |

|---|---|---|

| 0% This assesses a user’s timely repayments, defaults, missed payments, performances in bank transactions, etc. The fewer the defaults, the higher the score. | 1 This is the number of inquiries a user raises to view their credit files or reports. More queries to view credit reports lead to lower credit scores. | 0 This reflects accounts that have run into financial mistakes, failed payments, outstanding amounts, etc. The higher the negative results, the lower the score. |

Red Flag Indicators

Under the following circumstances, users also view Red Flags or dispute areas (generated through APIs and custom codes).

| If the credit utilization ratio is >0.4% | If the credit behavior ratio is >0.5% | If credit inquiry is >2 in the last 12 months |

| If repayment history is < 100% | If payment overdue is >0 | If negative account is >0 |

Credit Risk Precautions

Users move with caution when they see Red Flags and refrain from borrowing further loans.

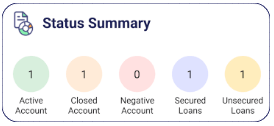

Loan Status Summary

Users also see a summarized format of their Red Flags in each of their loan accounts:

Paid Subscription Benefits

Although all users see Red Flags, paid users get to see exact inaccuracies in their loan accounts and commentaries from experts on how to avoid those Red Flags.

Credit Intelligence

As a result, paid users stand a chance to gather deeper credit intelligence and maintain a good score than unpaid users.

Bias-free Credit Analysis

Capital Numbers is excited to have developed this robust Fintech app that delivers the most authentic credit analysis reports powered by rule-based engines, thus, ensuring no human bias.

300+ Glowing Customer Reviews

97 out of 100 Clients Have Given Us a Five Star Rating on Google & Clutch

Get Custom Solutions, Recommendations, Resumes, or, Estimates. Confidentiality & Same Day Response Guaranteed!

Fill Out the Form and We Will Contact You.

What’s Next?

Our Consultants Will Reply Back to You Within 8 Hours or Less

Or, Email Us Your Needs At [email protected]

Expert Guidance You Can Trust. No Pitch, Just Expert Solutions.

+25 More Awards in Past Decade

Frequently Asked Questions

Based on the information provided about Capital Numbers, here arefive frequently asked questions (FAQs) and their answers

We offer a wide range of services, including:

- Digital Engineering: Custom software development, enterprise systems, automation tools.

- Web Development: Dynamic websites, e-commerce platforms, CMS solutions.

- Mobile App Development: iOS & Android apps, cross-platform solutions, app maintenance.

- QA (Quality Assurance): Automated and manual testing for error-free software.

- Cloud Engineering: Cloud migration, cloud infrastructure management.

- Data Engineering & Analytics: Data integration, data warehousing, data visualization, predictive analytics.

- AI/ML/GenAI: AI-driven analytics, machine learning solutions, generative AI applications.

- UI/UX Design: User interface design, prototyping & wireframing.

- Emerging Tech: AR/VR development, blockchain development.

We offer two distinct engagement models:

- Project-Based Development: Tailored solutions for defined goals, ideal for short-term projects.

- Dedicated Development Teams: Seamless integration, scalable solutions for long-term partnerships.

We have clients in various countries, including:

- USA

- UK

- Canada

- Australia

- Ireland

- Switzerland

- Saudi Arabia

- Indonesia

- UAE

- Israel

- Italy

We have received numerous awards, including:

- Clutch Top 1000 B2B Companies

- Financial Times High-Growth Companies

- The Economic Times India's Growth Champions

- Dun & Bradstreet Leading SMEs of India

- Manifest Global Awards

- Clutch Global Leaders

- Clutch Champion Awards

- GoodFirms: Trusted Choice Awards

- GoodFirms: Best Company to Work With

We were founded in 2012.

We are ISO 9001 and ISO 27001 certified, demonstrating quality and data security standards.

We create dynamic websites, e-commerce platforms, and manage content with user-friendly solutions.

We develop iOS & Android apps, cross-platform solutions, and provide ongoing maintenance.

We offer data integration, warehousing, visualization, and predictive analytics for data-driven decisions.

We offer AI-driven analytics, machine learning solutions, and generative AI applications for various needs.

Innovation, quality, client satisfaction, integrity, and teamwork are core values that guide our operations.

We aim to become a global leader in digital solutions, continuously innovating and empowering businesses with cutting-edge technology.