The Client

The client is in the digital lending segment, integrating more people and businesses into the credit system. They maintain a digital lending app that auto-determines a potential borrower’s creditworthiness and processes loan applications faster without compromising safety rules.

Industry

Finance

Tech Stack

ASP.NET MVC, ASP.NET Core, Razor View, TypeScript, MS SQL

The Challenges

Despite the successful implementation of this app, the client found a few loopholes still existing within it.

- First, the app had to have segregated user paths for every banking partner or lender.

- Second, it had to mandate users to follow predetermined steps for loan application.

- Third, it had to identify deviant user behaviors and anomalies.

- Fourth, it had to determine a borrower’s financial capacity and standing.

- Fifth, it had to authenticate and validate auto-generated loans.

The client observed these gaps and wanted an expert tech partner to handle the job. Impressed with Capital Numbers’ past Fintech projects, the client contacted us. Capital Numbers has emerged as a trailblazer in delivering successful Fintech projects to industry leaders.

So, when we bagged this project, we aimed to leverage our past expertise to deliver the best. We found many security compliance issues in the app. So, we worked towards resolving them to ensure the system’s compliance with various industry regulations.

Solutions We Offered

We assembled a team of expert .NET engineers for the job. Our team began focusing on five critical parameters, as discussed earlier:

- Segregating user paths for every lender

- Designing predetermined user paths

- Restricting deviations

- Discerning a user’s creditworthiness

- Authenticating loan offers

We first broke down the monolithic architecture into microservices. We did this because the monolith pattern was generalizing all user paths. But, multiple banks were offering various products to numerous users. So, every path had to be different. Therefore, we implemented the microservices pattern to differentiate one lender’s user path from the other.

We next created a log system to track whether every user undertook predetermined steps while applying for loans. We made sure the system instantly alerts any deviations here.

We then applied rules to determine a user’s creditworthiness. We ensured these rules help auto-generate loan offers based on user inputs and financial capacity.

We added extra layers of security to authenticate auto-generated loan offers. We set logic to auto-discern the legibility of every loan offer before floating them out to users.

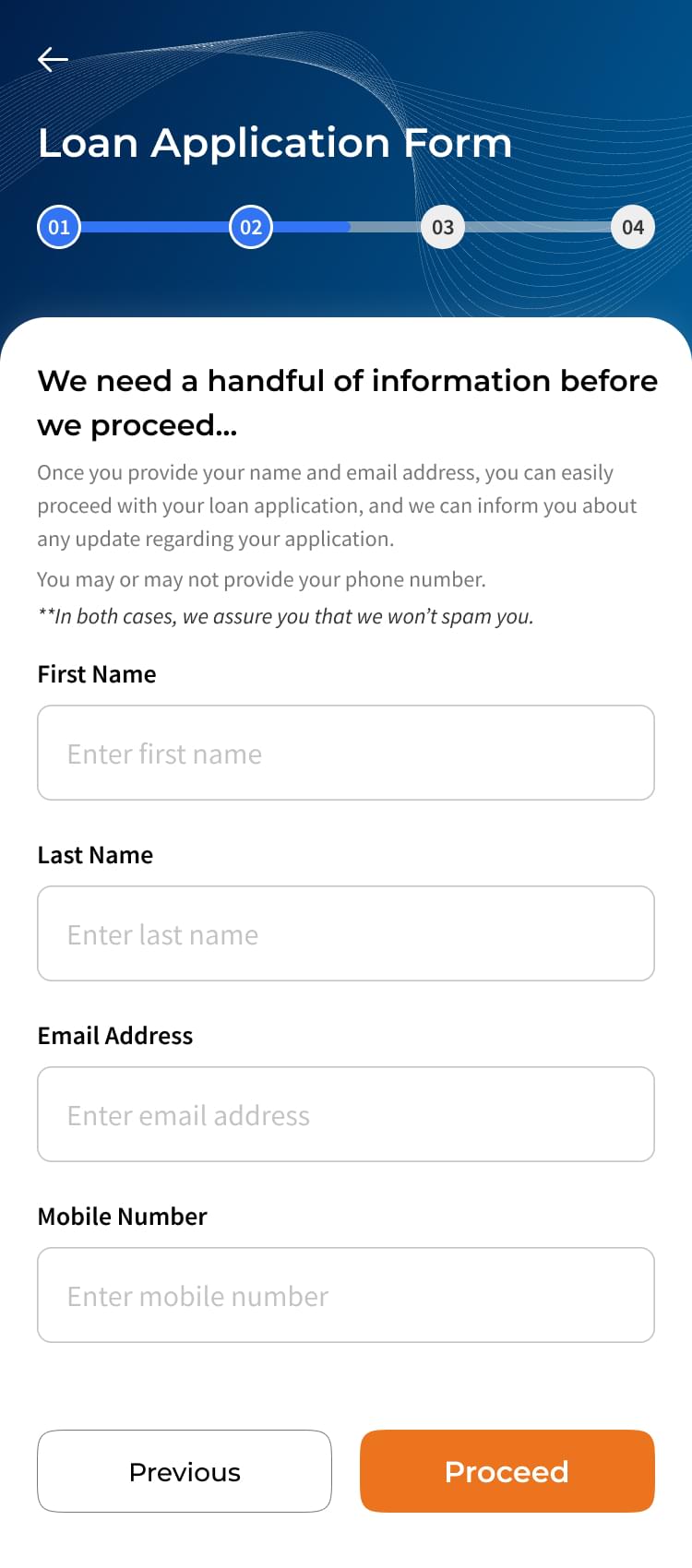

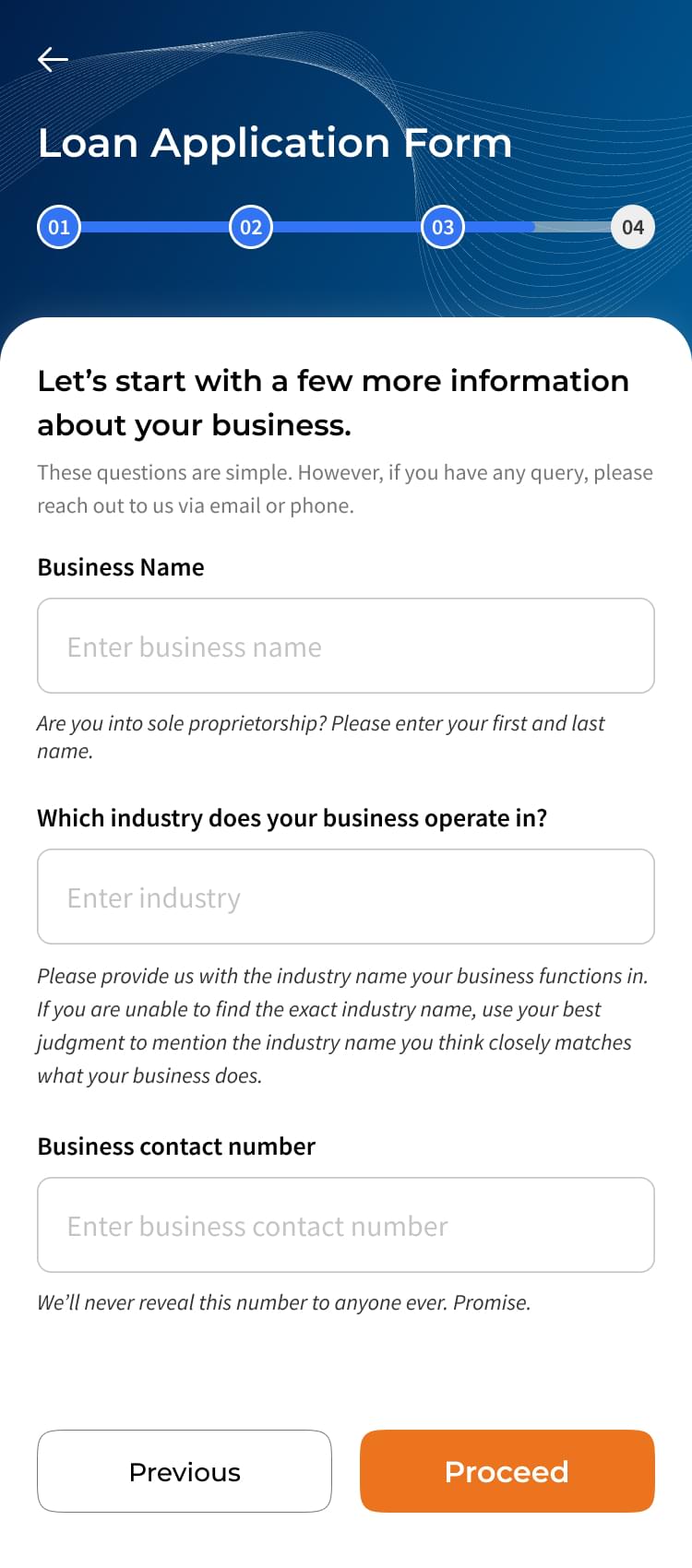

Aside from taking care of the above parameters, we added a mechanism to help users commence their loan application journey from where they had left off before discontinuation, ensuring the user flow isn’t affected. Suppose a user partially reaches a point (let's say Step 3 in their journey) and discontinues due to an unforeseen situation like a sudden network failure; the system would still enable the user to restart the process from Step 3.

Our team used a robust tech stack to implement all these critical solutions. We used ASP.NET MVC and ASP.NET Core for all backend enhancement tasks. ASP.NET MVC helped us decouple the app UI from the backend logic and make adjustments in the backend without impacting the frontend. ASP.NET Core was critical in making the app more high-performant. We wrote the frontend code using Razor View and used TypeScript to maintain the code better. We stored all data structures in the MS SQL server and mostly collaborated with the client over Slack for all our solutions.

Throughout the project, we faced many challenges fetching real APIs to test scenarios. In such situations, we created mock APIs to simulate tests and ensured the system fully complied with all regulatory and auditory checks.

Technology

Results

Our relentless contributions paid off. Our regulatory compliance checks highly impressed our client, who now prefers Capital Numbers over other vendors because here’s what we brought to the table:

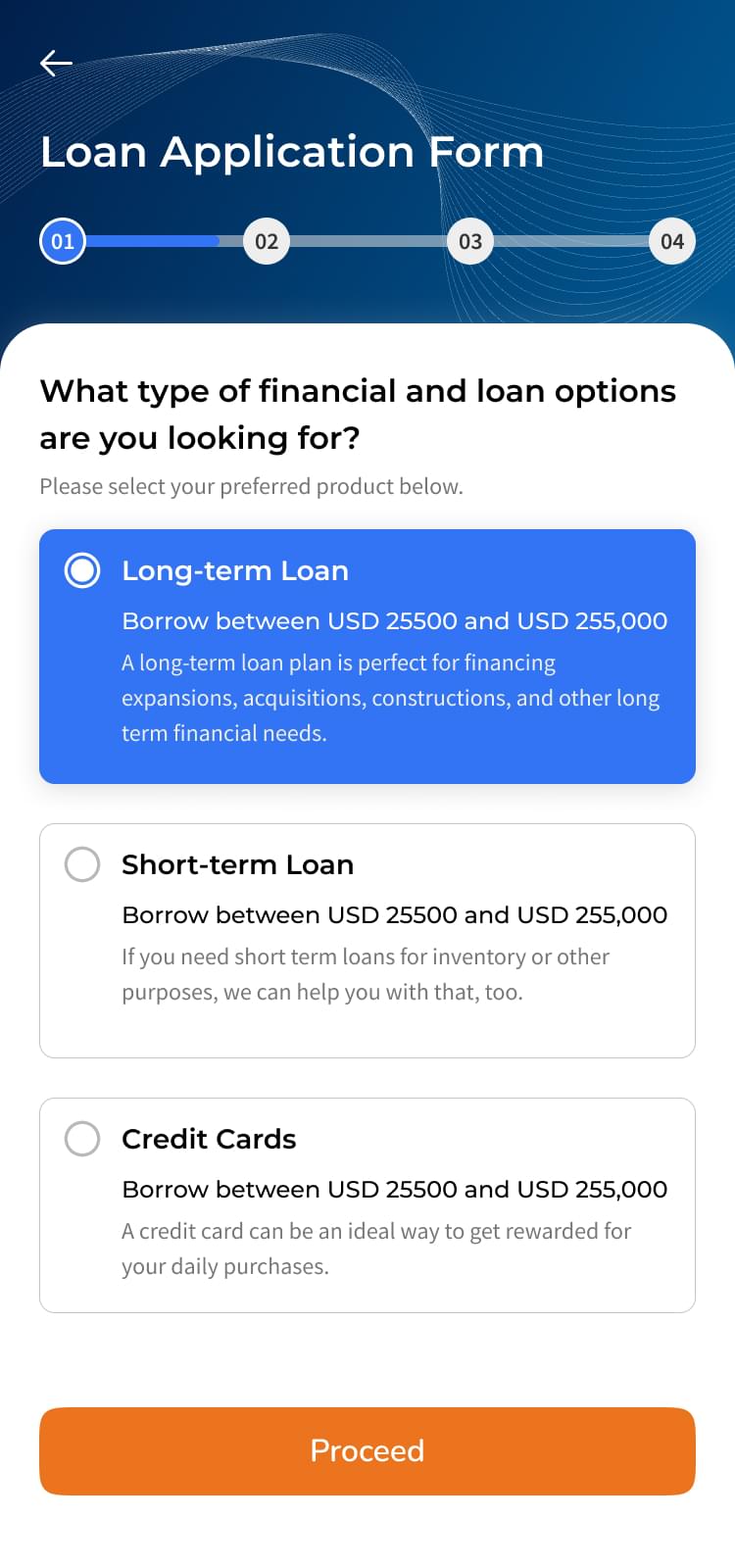

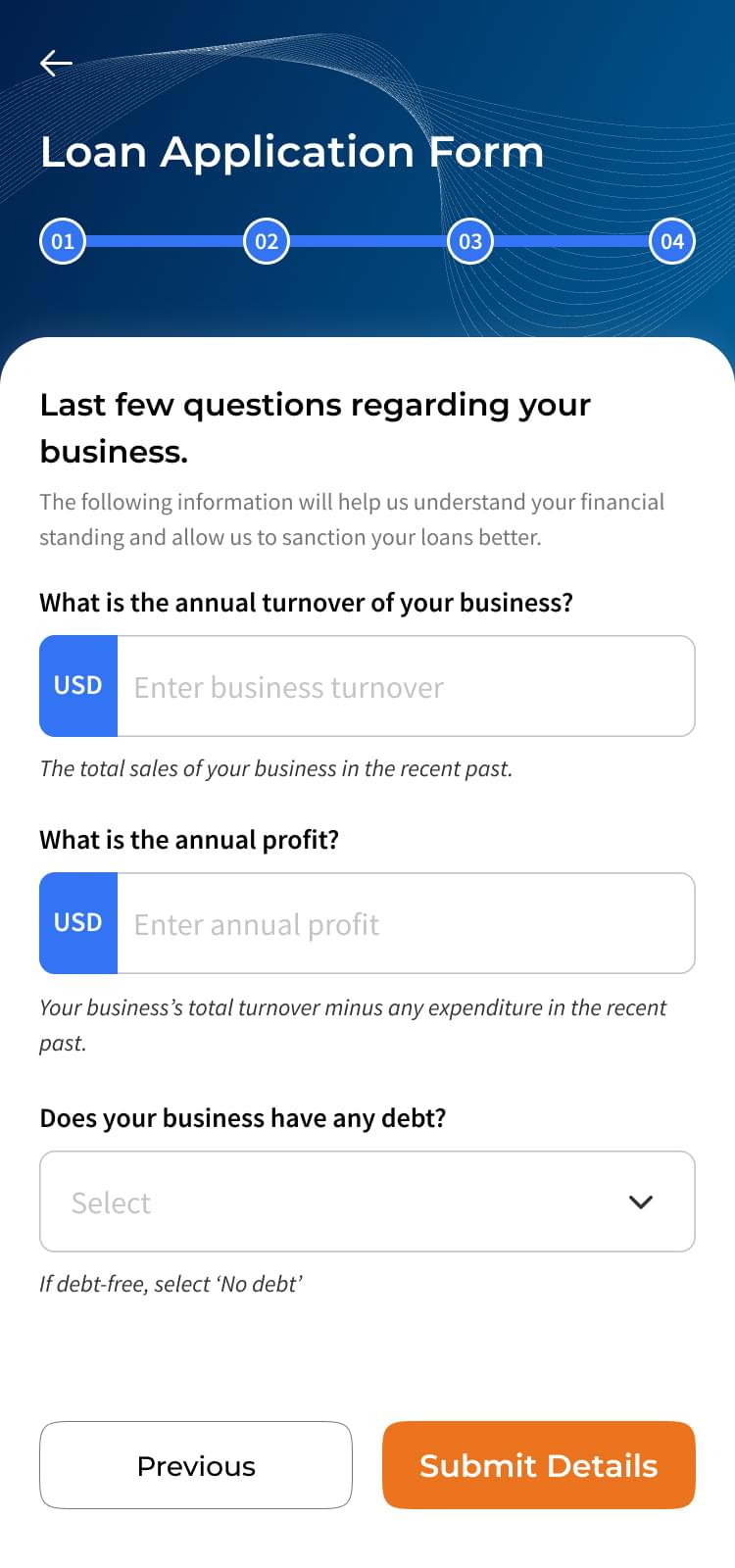

Predetermined User Flow

The app now mandates that every user completes their loan application journey by following predetermined steps, such as the following:

Deviation Control

If a user tries to bypass any of these steps, let’s say, jump from Step 1 to Step 3, the app notifies the admin about the deviation.

Compliance Checks

The app detects such deviations because of the compliance checks we’ve built into the app.

Individual User Paths

Because we segregated each product user flow, every bank now has a unique user path.

User Field Adjustments

Every user path auto-adjusts user fields as per user needs, customizing experiences further.

Creditworthiness Detection

Every user path collects user data to auto-determine a user’s financial standing.

Anomaly Detection

The system alerts the admin if a user’s financial standing is insufficient to repay the requested loan amount.

Auto-generated Loans

The system auto-generates loan offers if a user’s financial standing is good.

Authenticated Loans

Before generating loan offers, the system verifies the authenticity of the loan offer.

Audit Logs

The system maintains audit trails for all loan offers floated and other events.

100% Audit-compliance Solutions

All in all, it was daunting to implement such Fintech security at so many different levels. But, thanks to our skilled team that implemented the most robust tools to make the system risk-free, 100% audit-compliant, and suitable for all regulatory checks.

300+ Glowing Customer Reviews

97 out of 100 Clients Have Given Us a Five Star Rating on Google & Clutch

Get Custom Solutions, Recommendations, Resumes, or, Estimates. Confidentiality & Same Day Response Guaranteed!

Fill Out the Form and We Will Contact You.

What’s Next?

Our Consultants Will Reply Back to You Within 8 Hours or Less

Or, Email Us Your Needs At [email protected]

Expert Guidance You Can Trust. No Pitch, Just Expert Solutions.

+25 More Awards in Past Decade

Frequently Asked Questions

Based on the information provided about Capital Numbers, here arefive frequently asked questions (FAQs) and their answers

We offer a wide range of services, including:

- Digital Engineering: Custom software development, enterprise systems, automation tools.

- Web Development: Dynamic websites, e-commerce platforms, CMS solutions.

- Mobile App Development: iOS & Android apps, cross-platform solutions, app maintenance.

- QA (Quality Assurance): Automated and manual testing for error-free software.

- Cloud Engineering: Cloud migration, cloud infrastructure management.

- Data Engineering & Analytics: Data integration, data warehousing, data visualization, predictive analytics.

- AI/ML/GenAI: AI-driven analytics, machine learning solutions, generative AI applications.

- UI/UX Design: User interface design, prototyping & wireframing.

- Emerging Tech: AR/VR development, blockchain development.

We offer two distinct engagement models:

- Project-Based Development: Tailored solutions for defined goals, ideal for short-term projects.

- Dedicated Development Teams: Seamless integration, scalable solutions for long-term partnerships.

We have clients in various countries, including:

- USA

- UK

- Canada

- Australia

- Ireland

- Switzerland

- Saudi Arabia

- Indonesia

- UAE

- Israel

- Italy

We have received numerous awards, including:

- Clutch Top 1000 B2B Companies

- Financial Times High-Growth Companies

- The Economic Times India's Growth Champions

- Dun & Bradstreet Leading SMEs of India

- Manifest Global Awards

- Clutch Global Leaders

- Clutch Champion Awards

- GoodFirms: Trusted Choice Awards

- GoodFirms: Best Company to Work With

We were founded in 2012.

We are ISO 9001 and ISO 27001 certified, demonstrating quality and data security standards.

We create dynamic websites, e-commerce platforms, and manage content with user-friendly solutions.

We develop iOS & Android apps, cross-platform solutions, and provide ongoing maintenance.

We offer data integration, warehousing, visualization, and predictive analytics for data-driven decisions.

We offer AI-driven analytics, machine learning solutions, and generative AI applications for various needs.

Innovation, quality, client satisfaction, integrity, and teamwork are core values that guide our operations.

We aim to become a global leader in digital solutions, continuously innovating and empowering businesses with cutting-edge technology.