Cybersecurity Best Practices for Fintech Software Development

Table of Contents

In the rapidly evolving landscape of financial technology, the significance of cybersecurity cannot be overstated. As fintech continues to revolutionize how we manage and interact with our finances, ensuring the security and integrity of these digital solutions is vital. The fusion of finance and technology brings innovative services, such as mobile banking, peer-to-peer payments, and automated investments, each presenting unique cybersecurity challenges. In this dynamic environment, adopting robust cybersecurity practices is crucial to safeguard sensitive financial data from emerging threats and maintain users’ trust.

If you’re leading a fintech firm and looking to develop or upgrade your fintech mobile and web apps, choosing a financial software development company with a strong focus on cybersecurity is crucial. Such a company excels in innovation and cybersecurity and ensures your solutions are advanced and secure against complex digital threats. By partnering with a firm that follows high-standard cybersecurity into its development process, you can set your fintech offerings apart. For a better understanding of the essential cybersecurity best practices that can enhance your fintech solutions, read on.

Why is Fintech Cybersecurity Important?

Fintech cybersecurity is important for various reasons, including,

-

Protection of Financial Data

Fintech companies handle sensitive financial information, including personal and payment data. Ensuring the security of this data is essential to protect customers from identity theft, fraud, and financial losses.

-

Trust and Reputation

Fintech firms rely heavily on trust. Any security breach or data leak can hurt customer trust and damage the company’s reputation, potentially leading to loss of customers and business opportunities.

-

Financial Stability

Cyberattacks can damage fintech operations, causing financial losses and instability. Maintaining robust cybersecurity measures is crucial to safeguard the company’s and its customers’ financial stability.

-

Innovation and Growth

Fintech is a dynamic and rapidly evolving sector. Secure systems and data protection are fundamental for fostering innovation, attracting investors, and supporting growth in the industry.

-

Competitive Advantage

Fintech firms that prioritize cybersecurity can use it as a competitive advantage. Demonstrating a strong commitment to protecting customer data can attract more users and partnerships.

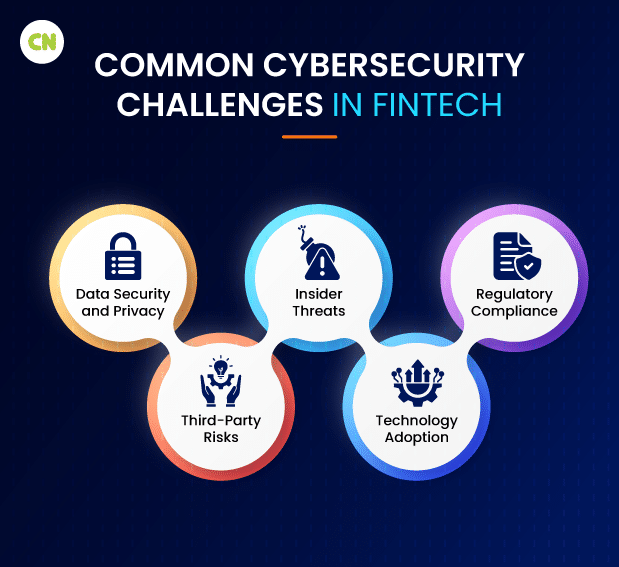

Cybersecurity Challenges in Fintech

If you are considering fintech app development, it’s crucial to be aware of the following challenges:

-

Data Security and Privacy

Fintech companies handle vast amounts of sensitive financial and personal data, including customers’ financial records, transaction histories, and unique identifiers. The challenge lies in safeguarding this information from breaches and unauthorized access. With increasing cyberattacks targeting financial data, maintaining data security measures is essential to protect customer trust. Ensuring compliance with data privacy regulations like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) is vital to avoid severe legal consequences.

-

Insider threats

Insider threats are another cybersecurity challenge within the fintech industry. These threats arise from individuals within the organization, such as employees or contractors, who have authorized access to sensitive financial data and systems. Insider threats encompass intentional actions, like data theft, and unintentional actions, such as falling prey to phishing attempts, making them a critical concern for fintech companies.

-

Regulatory Compliance

The fintech industry operates within a complex regulatory landscape. Companies should follow financial regulations, including PSD2 (Payment Services Directive 2), KYC (Know Your Customer), AML (Anti-Money Laundering), and more. Complying with regulations can be difficult and expensive, as they change over time and vary by location.

-

Third-Party Risks

Fintech companies often rely on third-party vendors for services like payment processing, data storage, or software development. While outsourcing can bring efficiency and expertise, it also introduces security risks. Managing and mitigating these risks through vendor assessments, security audits, and contractual agreements are vital to ensuring that third-party relationships do not compromise the security of fintech operations.

-

Technology Adoption

Fintech firms are early adopters of cutting-edge technologies, including cloud computing, mobile applications, and blockchain. While these technologies offer many benefits, they also expand the attack surface and introduce new vulnerabilities. Ensuring that these technologies are implemented securely, with proper access controls and encryption, poses an ongoing challenge as the fintech industry continues to evolve and innovate.

Best Practices for Fintech Security

Fintech companies should follow effective prevention measures to safeguard their systems, data, and customer trust in an increasingly digital and interconnected world. Here are some best practices for fintech security:

-

Data Encryption

Implement robust encryption protocols to protect sensitive data effectively.

-

Access Controls

Use strict access control mechanisms to ensure only authorized personnel can access critical systems and data.

-

Regular Audits

Conduct regular security audits and vulnerability assessments to identify and address potential weaknesses.

-

Incident Response Plan

Develop a comprehensive incident response plan to mitigate the impact of security breaches and respond quickly to any incidents.

-

User Authentication

Implement multi-factor authentication (MFA) to enhance user login security.

-

Patch Management

Keep all software and systems up to date with the latest security patches to address known vulnerabilities.

-

Third-Party Risk Management

Assess the security practices of third-party vendors and partners to mitigate risks associated with external relationships.

-

Employee Training

Provide employees with ongoing cybersecurity training and awareness programs to prevent social engineering attacks.

-

Compliance Frameworks

Follow relevant financial and data privacy regulations, such as GDPR, PCI DSS, and PSD2.

-

Secure Coding Practices

Train developers in secure coding techniques to minimize the risk of introducing vulnerabilities during app development.

-

Cloud Security

Implement robust security measures for cloud services, including data encryption and access controls.

-

Regular Penetration Testing

Conduct penetration testing to simulate attacks and identify vulnerabilities in your systems.

-

Monitoring and Alerts

Deploy real-time monitoring tools to detect and respond to suspicious activities promptly.

-

Data Backups

Regularly backup critical data to ensure quick recovery in case of data loss or ransomware attacks.

-

Privacy by Design

Integrate privacy and security measures into the design of your fintech applications from the outset.

-

Secure APIs

Apply security practices to protect your APIs, which attackers often target.

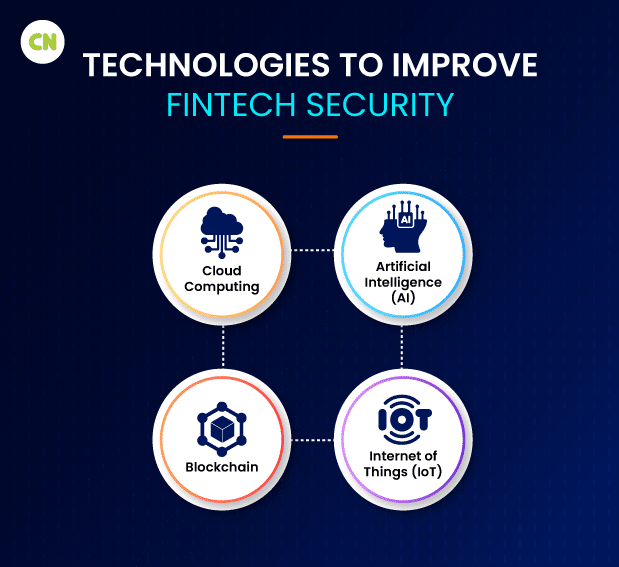

Cutting-edge Technologies to Improve Fintech Security

-

Cloud Computing

Secure Cloud Environments: Fintech firms can access robust security features like data encryption, access controls, and monitoring through cloud services.

Scalability and Resilience: Cloud computing allows fintech companies to expand their infrastructure easily and ensure uninterrupted business operations during cyberattacks or disasters.

Security-as-a-Service (SECaaS): Leveraging SECaaS solutions from cloud providers can improve threat detection, vulnerability management, and incident response, allowing fintech companies to focus on their core services.

-

Artificial Intelligence (AI)

Fraud Detection: AI-driven algorithms can analyze vast datasets in real time to detect fraudulent transactions by identifying unusual patterns and behaviors.

Behavioral Biometrics: AI can analyze user behavior, such as typing speed and navigation patterns, for advanced user authentication, making it difficult for malicious individuals to pretend to be genuine users.

Predictive Security: AI can predict potential security threats and vulnerabilities by analyzing historical data and identifying emerging risks before they materialize.

-

Blockchain

Immutable Transactions: Blockchain technology provides an immutable ledger, ensuring the integrity of financial transactions and audit trails. It reduces the risk of tampering or fraud and, thus, revolutionizes financial services.

Smart Contracts: Smart contracts automate financial agreements with predefined rules, executing transactions only when specific conditions are met. It minimizes the need for intermediaries and ensures security.

-

Internet of Things (IoT)

IoT Security Protocols: Secure IoT protocols and standards and device authentication ensure the confidentiality and integrity of data transmitted between IoT devices and fintech platforms.

Real-time Data Monitoring: IoT devices can provide real-time data on financial transactions, enabling fintech companies to quickly detect and respond to security incidents.

Device Management: Effective IoT device management and patching mechanisms are essential to mitigate vulnerabilities and protect against potential breaches. MDM (Mobile Device Management) software enables centralized control and remote patching of IoT devices to reduce security risks.

The Future of Fintech Security

-

AI and ML Security

In the future, fintech security will benefit from artificial intelligence and machine learning. These technologies will help detect and respond to security threats faster and more accurately. They can spot unusual patterns in data, like detecting a potential hack, and even take action automatically, like blocking a suspicious account.

-

Biometric Authentication

Fintech security is moving towards using unique physical features, like fingerprints, facial features, or iris scans, to confirm a user’s identity. It is more secure than traditional passwords because these physical features can’t be easily copied or stolen.

-

Quantum-Resistant Security

As quantum computing develops, it could break some existing encryption methods. So, researchers are working on new ways to keep financial data safe from quantum computers.

-

Privacy Regulations

New rules about data privacy are changing how fintech companies handle your information. They should be more careful about collecting, using, and protecting your data. This is not just about following rules; it’s also about winning customers’ trust by keeping their data safe.

-

Cyber Insurance

Cyber insurance covers data breaches, business disruptions, threats, and third-party claims. It’s tailored to your needs, addressing your costs (like breach investigations) and third-party expenses (like legal damages). It also provides support services such as breach response planning, incident teams, and legal and PR assistance.

-

Cyber Threat Intelligence

Cyber threat intelligence identifies cybercriminal tactics and system vulnerabilities from sources like open data and human insights. It’s vital as threats evolve, giving organizations a better picture and enabling proactive protection.

Read More: Blockchain Breakthroughs: Transforming Authentication, Authorization, and Accounting

Frequently Asked Questions

-

What is fintech security?

Fintech security protects financial technology systems and data from unauthorized access, breaches, and cyber threats to ensure the integrity and confidentiality of financial transactions and customer information.

-

How can you ensure cloud security & compliance in fintech?

Ensuring cloud security and compliance in fintech involves implementing robust security protocols, encryption, access controls, and continuous monitoring to safeguard sensitive financial data and meet regulatory requirements.

-

What is the role of compliance in FinTech?

Compliance in fintech plays a crucial role in adhering to regulatory standards and guidelines. It ensures that financial technology companies operate within legal boundaries, protect customer data, and maintain trust in the industry.

-

Is fintech at high risk?

Fintech companies are exposed to various risks, including cybersecurity threats, regulatory challenges, and market fluctuations, highlighting the importance of robust risk management practices within the industry.

You May Also Read: Cybersecurity in the Digital Age: Protecting Your Web Applications from Threats

Final Thoughts

The path to achieving robust cybersecurity in fintech is ongoing and multi-dimensional. It demands a vigilant approach, a commitment to adopting the latest technological advancements and following comprehensive regulatory standards. As fintech firms strive to offer seamless and secure financial services, the need for developing and implementing thorough, forward-looking cybersecurity strategies cannot be underestimated.

By investing in advanced protective measures and partnering with companies offering top-notch financial development services, fintech companies can effectively protect themselves against today’s cyber threats and strengthen their defenses for the challenges of tomorrow. Ultimately, fintech’s future depends on its innovative financial services and ability to keep the supporting platforms secure and reliable.